CBX-O, Born on Cloud

ExploreSteps

User Journeys

The success of a lending business depends on acquiring the right customer at the right price and hence Origination becomes the most crucial component in a loan’s lifecycle. Loan origination as a process touches varied stakeholders such as a prospective customer, RM, underwriter, risk manager, operations team and external agencies such as DSAs and verification agencies. CBX-O is a collection of powerful user journeys that have integrated seamlessly to deliver enhanced efficiency with a friendly UI resulting in a higher productivity.

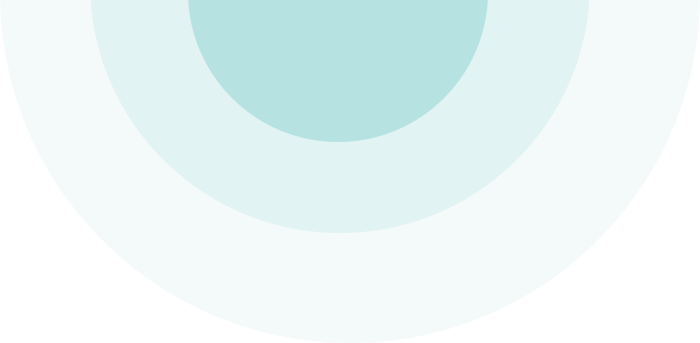

Initiation from Mobile Channel

Relationship Manager is the first point of contact through the entire lifecycle of Credit. He meets prospects & customers, performs real-time/offline activities such as initiating new credit request, documentation and proposing relevant facilities.

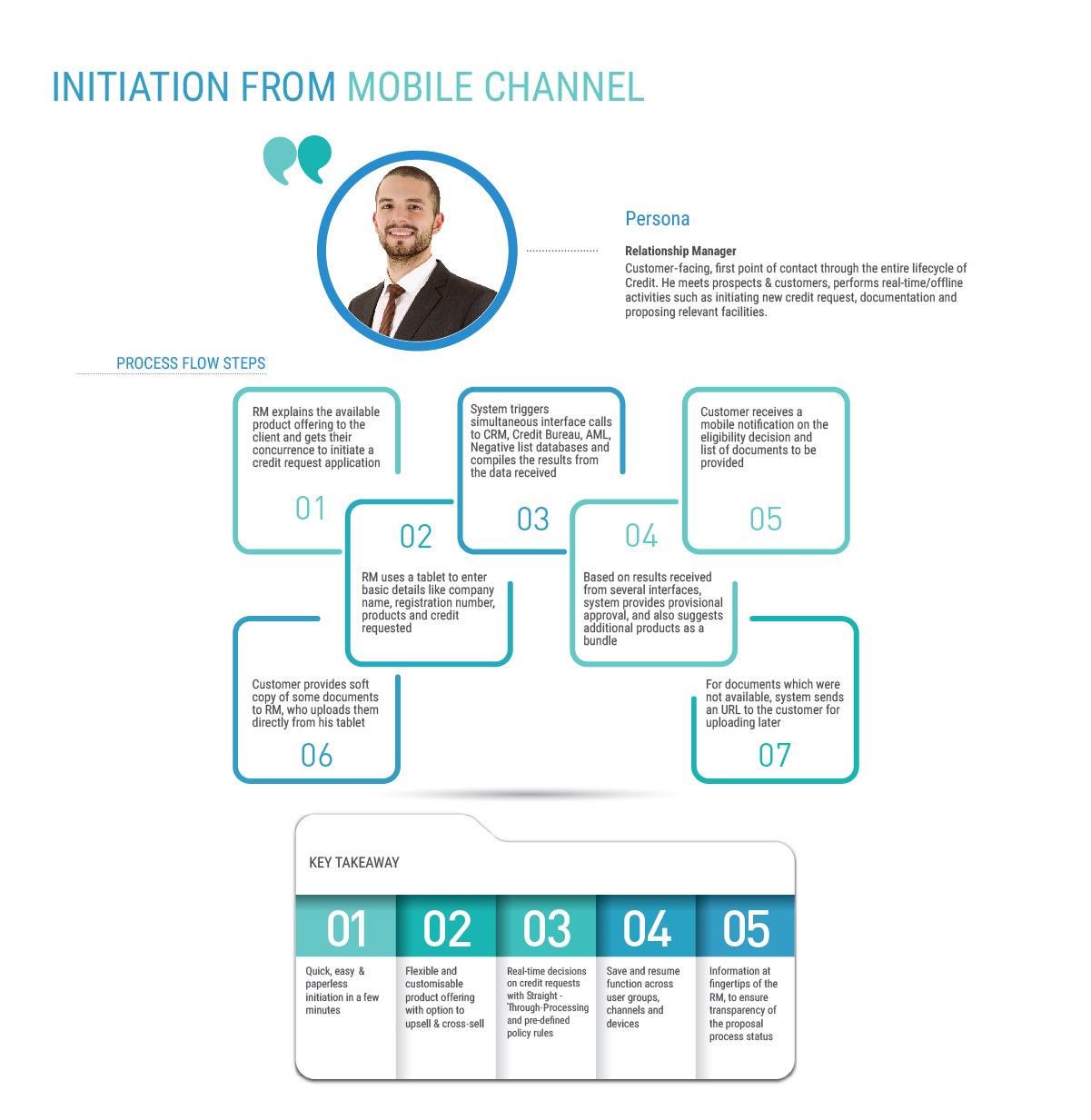

Proposal Initiation Processing

Sales Operations Officer plays a crucial role in aggregating customer data. Lead role in product fitment with expertise in channelising the credit request across related teams like Verification, Credit & Sales.

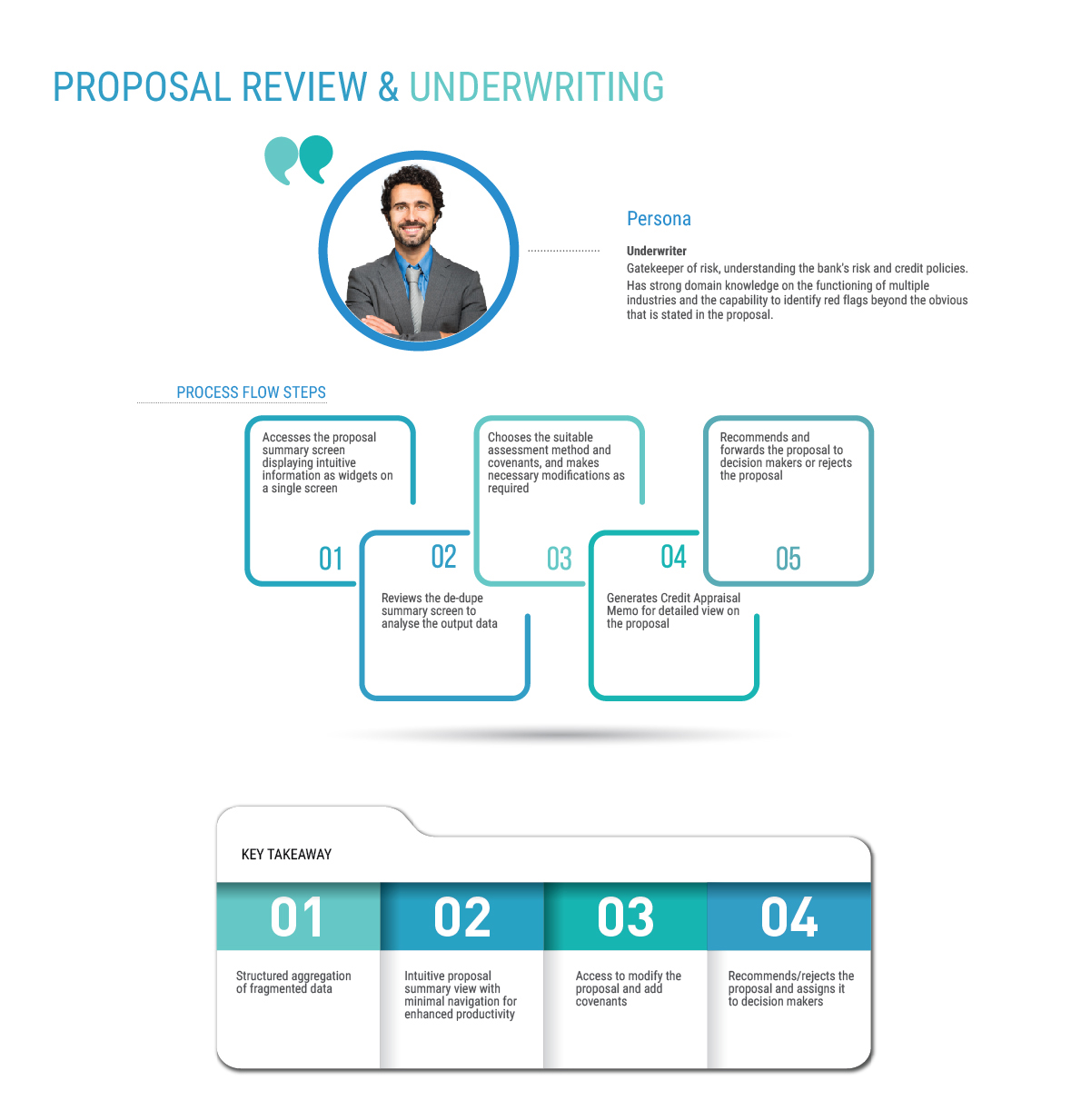

Proposal Review & Underwriting

Underwriter is the gatekeeper of risk, understanding the bank’s risk and credit policies. Has strong domain knowledge on the functioning of multiple industries and the capability to identify red flags beyond the obvious that is stated in the proposal.

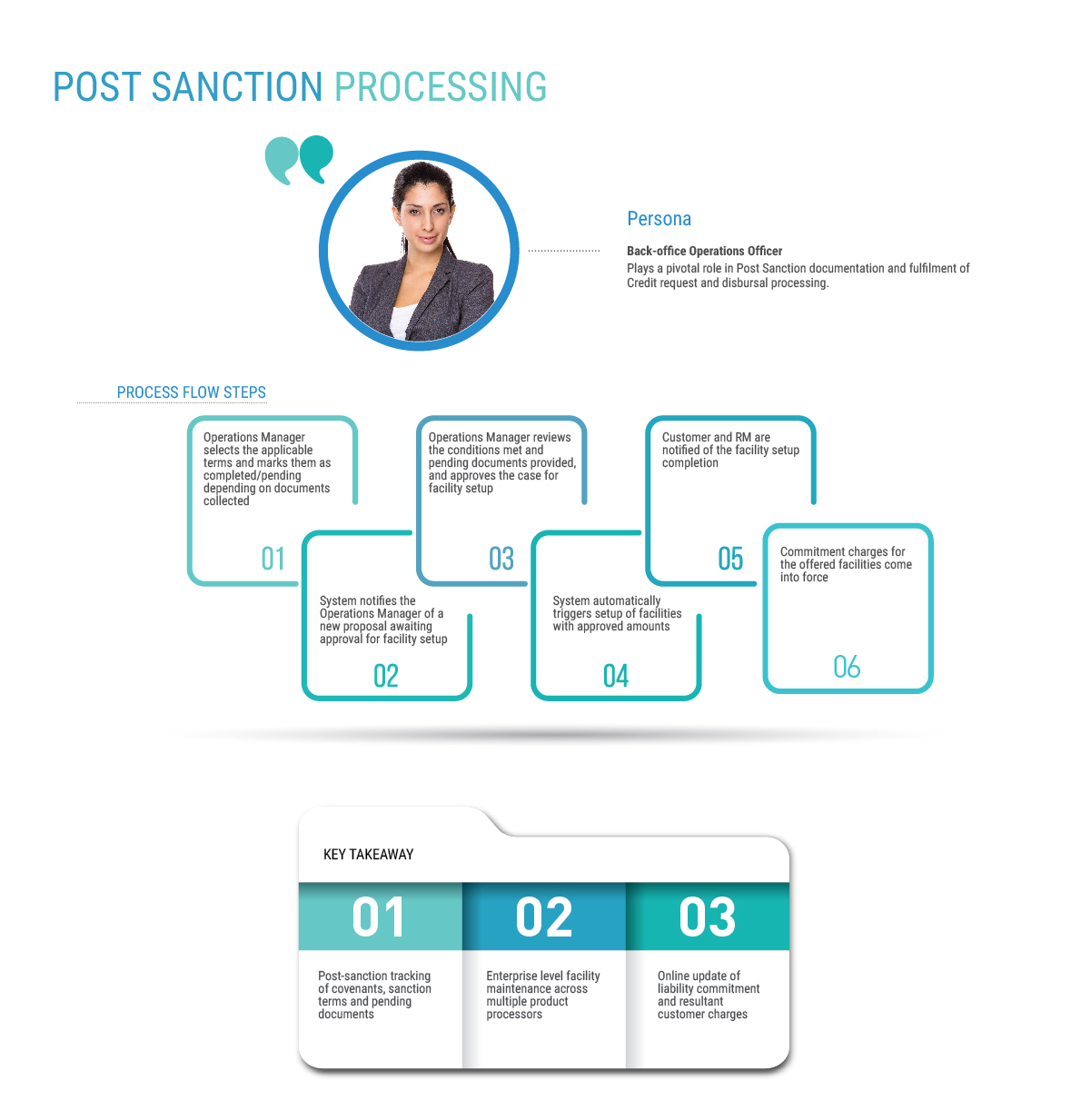

Post Sanction Processing

Back-office Operations Manager plays a pivotal role in Post Sanction documentation and fulfilment of Credit request and disbursal processing.

Want to know more?

Experience the power of CBX-O, enabling organisations increase operational efficiency by optimising risk and delivering real-time informed credit decisions.

Please share your details and we will be happy to schedule an exclusive demo for your team and you.